The portfolio and indexes weekly return

The momentum portfolio outperformed the indexes this week too (but not in a good way*). The following is the weekly total returns for the portfolio compared to the index. As you can see my momentum portfolio lost money but much less than the broad market, So in one way the portfolio did outperform the indices. This is a very good sign, IMO since if the draw downs are less when the markets tank, it think the portfolio has done good job of risk mitigation.

|

I am using Morningstar US market index as a benchmark. Thus the portfolio outperformed the market and beat it this week.

Total Return: measures

the theoretical performance of your holdings for a specified period of

time, taking into account the beginning and end values of your

investments as well as dividends.

Personal Return calculates

the investor's returns, taking into account an additional factor in its

calculation: the capital that you added or withdrew from your fund or

portfolio throughout the specified period of time. The calculation of

Personal Return illustrates how your allocation of capital has affected

the performance of your portfolio.

One of the things I have taken away from the last few months of tech/Nasdaq debacle is that there needs to be a risk system in addition to a reward system. The momentum portfolio automatically kicks in the risk mitigation when bullish momentum for stock is worsening and thus capping losses.

This system worked beautifully well and this draw downs were capped in particularly volatile week.

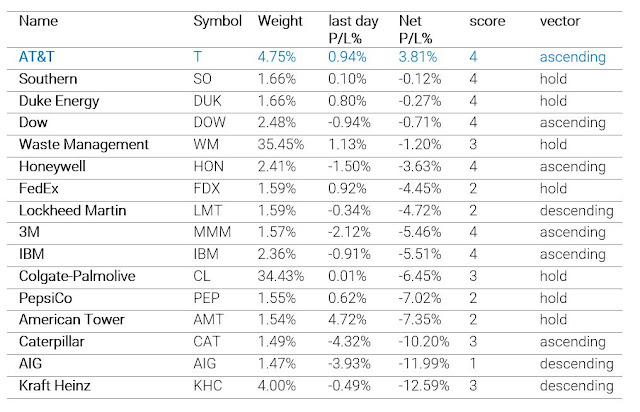

Positions, Position Sizes and Momentum Updates

The only position that is still in green in AT&T (T), others are in red at the moment.

Score classification

- Score 0: Super bearish, no entry

- Score 1: bearish, no entry

- Score 2: Hold

- Score 3: bullish, entry or hold

- Score 4: bullish, entry or hold.

As it turns out the momentum scores can also assist with position sizing, with those that have the most favorable scores-setups have more additions to the positions making those portfolio positions heavier.

Thanks for reading! Next post will be end of week 21, on or about May 28, 2022. Until then keep tracking the momentum!