Summary

- Here in is presented a novel method to analyze underlying business to understand connections, synergies, scale, shared strategic resources & inter-dependencies that may make UPST a stellar company.

- This type of analysis is complementary to the conventional methods of fundamental or technical analysis, and lets semantic data reveal the patterns and relationships. Connect the dots.

- Based on my concept analysis, Upstart Inc is a disruptor, filling an unmet need. It has the vision and an operating mechanism for growth.

anilakkus/E+ via Getty Images

A deep dive into Upstart Holdings Inc. (Ticker: UPST). Network analysis of concepts fiscal quarter end June 2021.

Introduction

There are many services that provide stock or company analysis, those analysts choose either fundamental data (numbers like profit, loss, revenue etc.) or technical analysis (stock price action) which are important for evaluation of the company. This article is not it.

This article presents a method to understand the underlying business and to get a sense of connections, synergies, scale, interconnections, shared strategic resources and inter-dependencies that make a company successful.

Background

In graph theory, a graph (network) is a structure containing a set of objects in which the objects are in some sense “related”. The objects can be ideas, concepts, discrete elements. I use visual and network analysis in medicine and biology to analyze relationships between proteins, genes, diseases etc. I am applying similar principles to do deep dives of companies to analyze companies to invest in.

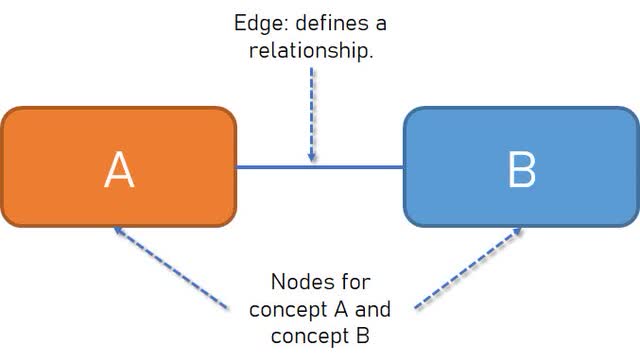

A network graph is made of nodes and connections (edges). Each node is a tangible concept or entity. Lines connecting the nodes are relationships between any two entities are called edges. Thus, if 2 entities are related, there is a line (edge) connecting 2 nodes. In the most reductive sense, this is represented in the figure 1, with 2 nodes and 1 edge. This type graph is an excellent tool to represent relationships between 2 ‘concepts’.

Figure 1: A simple network, concept nodes (A and B) connected by an edge relation

veuepoint (self)

These graphs are a non-random mathematical models of relationships. This process is unsupervised (no human bias) and lets the data reveal the patterns and relationships , allowing confirmation of the known and to reveal the unknown.

Such tools can help increase understanding and reading between the lines. In my opinion, this type of analysis is crucial but severely lacking. Intangibles like company work culture, mission, flywheels, synergies, leadership can be “discovered” by such tools. With this background, lets analyze the concepts presented in the conference call for fiscal quarter ending June 2021 (UPST)

Unsupervised concept network analysis of Upstart and its AI platform

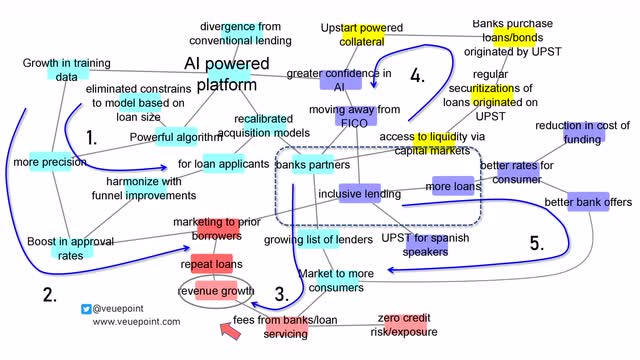

Figure 2: The entire unsupervised network of concepts related to Upstart AI platform

Veuepoint (self)

The above figure is busy so let me break it down into ‘smaller models’ which lets us look at it in detail.

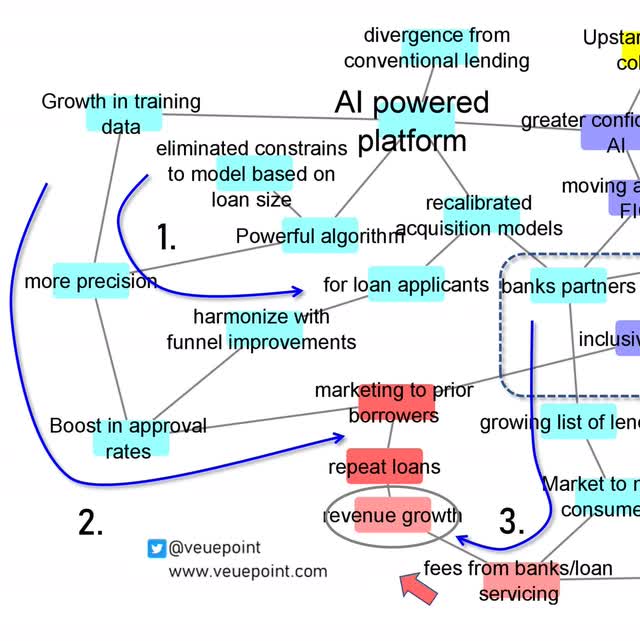

Figure 2A: Upstart AI platform concept analysis closer look at concepts 1, 2 and 3

Veuepoint.com (self)

1) A platform (and the business) which gets better over time.

This section of the network model shows the amazing internal flywheels that are synergistic to the workings of Upstart. Lets begin with our attention to the left of the figure (blue arrow #1). This section describes the AI platform and the developments that upstart has implemented for it. The AI platform is a self learning entity, the more data it processes the better it gets at making decisions. This growth in training data leads to more precision and then in turn leads to a boost in approval rates for applicants. This leads to more loans being approved which in turn leads to refinement of the algorithm. Thus one can envision, this process to get better and better over time, and be able to identify those applicants which are loan worthy but missed by other scores (Like FICO).

2) Revenue growth multipliers

The next concept that is evident from the network map is shown by blue arrow #2. Here the improvement in AI algorithm, translates to revenue growth. This is achieved by the intermediary steps of increased precision, leading to boost in approval rates, leading to approving more borrowers. The company also has stated emphasis on marketing to prior borrowers. This is an excellent strategy since they have already qualified by upstarts AI and have demonstrated the ability to pay back the loans. These repeat loaners add to revenue growth.

3) Increase in lenders adds to borrower related revenue growth

The third network concept is highlighted by blue arrow #3. This revenue growth is not only being increased by growth in first time and repeat loan applicants, it is also growing as the number of lenders increases. This allows the banks to market to more consumers and this provides fees from banks for loan servicing (Blue arrow #3). The important aspect of this revenue stream is that Upstart is able to achieve this growth with zero credit risk or exposure. This is borne by banks and not by Upstart.

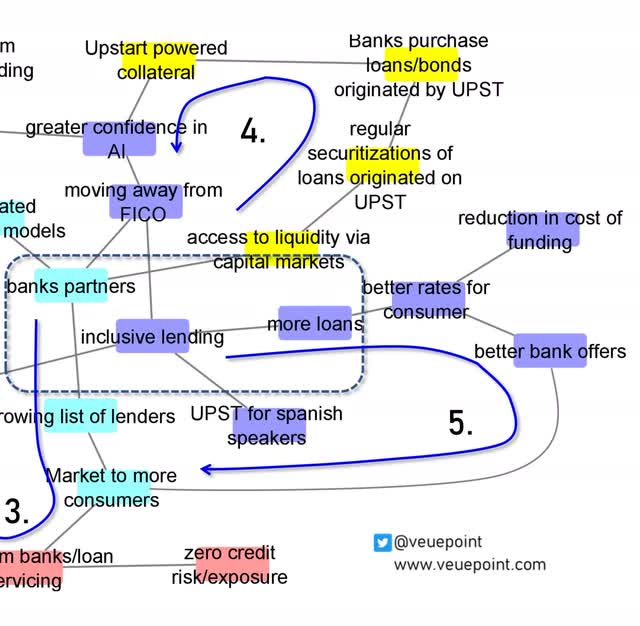

Figure 2B: Upstart AI platform concept analysis closer look at concepts 4 and 5

Veuepoint.com (Self)

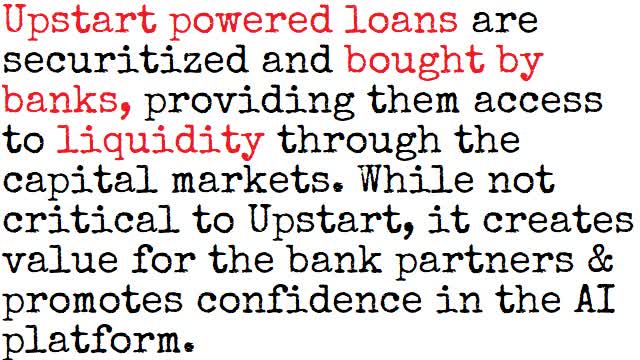

4) Upstart powers collateral that partner banks can use

The fourth segment of this network is the part in yellow on top right and is an interesting one. Upstart is able to provide access to liquidity to banks by exposure to capital markets. The loans that originate at Upstart can be “securitized” and sold to banks that are willing to buy them. This upstart “powered” collateral that banks have (bonds, loans), allows banks access to more liquidity and capital.

Concept card 1: liquidity and access to capital markets

Veuepoint.com (self)

This is not necessary for working of upstart but provides an excellent service and value to the partner banks. This increases the working relationship that banks have with Upstart. This also has another benefit, as banks work with this upstart originated collateral, they are also demonstrating greater confidence in AI platform and this has lead to some banks discontinuing legacy scoring systems like FICO altogether. That is an exceptionally disruptive nature of the this arrangement.

5) "Inclusivity" revealed as the central tenet

The last segment of the network are the purple nodes on the right, this deals with the nature of the platform and its goal of inclusivity. As more loans are offered, upstart and bank partners are able to offer better rates to the consumer, leading to better offers from the bank and overall reduction in cost of funding the loan. This is a virtuous cycle which keeps working to improve at each iteration, lend more, to more eligible applicants and have them and banks get a better deal out of the transaction.

The network began with AI powered platform as the starting node. However, when all the concepts were linked and connected, the central nodes that seem to be the crux of the graph are bank partners – inclusive lending – more loans. This tenet is central to the working of the company and the network map generated by unsupervised non-random modeling was able to pin it down to this. Their mission to enable effortless credit based on true risk is acted on by a culture of “inclusive lending”.

Their modus operandi is exemplified by their mission statement “to enable effortless credit based on true risk. We are a leading artificial intelligence (NYSE:AI) lending platform designed to improve access to affordable credit while reducing the risk and costs of lending for our bank partners. Our platform uses sophisticated machine learning models to more accurately identify risk and approve more applicants than traditional, credit-score based lending models.”

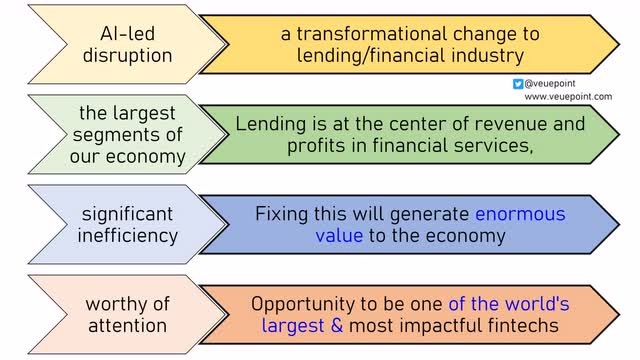

Concept card 2: Upstart Key drivers and consequences

Veuepoint.com (self)

As seen in the figure above, the key concepts that drive Upstart have huge consequences. Lending is the center of revenue and profits in financial services. This is one of the largest segments of the economy. However, lending is fraught with inefficiencies. Artificial intelligence can assist in eliminating these inefficiencies. This can generate enormous value to the economy. AI powered lending could be the most transformational change for this industry and provides Upstart the opportunity to become one of the world’s largest and most impactful fintechs in the years to come.

But wait there is more..

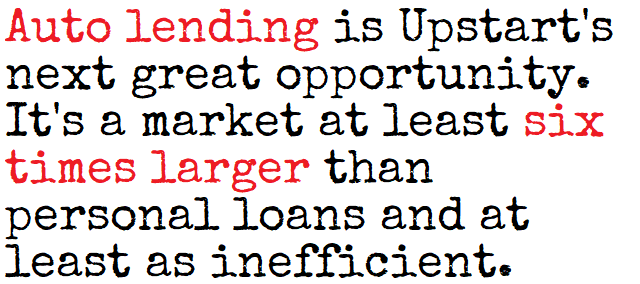

Upstart auto lending could be the new hyper-growth venture.

Concept card 3: Autolending is larger than Personal loans

Veuepoint.com (Self)

Upstart (UPST) recognizes the potential for growth in a related business by applying similar principles as personal loans to car loans. The figure below shows network model of concepts for auto lending. I will discuss key themes that stood out.

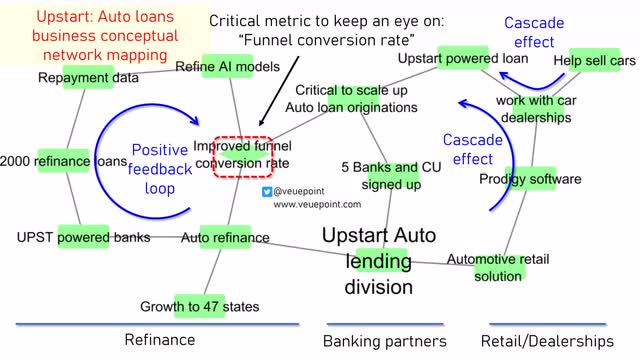

Figure 3: Auto lending segment and Upstart concept network mapping

Veuepoint.com (Self)

A positive feed back loop

The auto refinance sector, via upstart powered banks offer loans to applicants. This is also based off their Artificial intelligence algorithm which makes a determination of eligibility just as it does in the personal loans space. As of their earnings update in August 2021, they had 2000 loans. The repayment data from these loans is utilized to refine the AI models, which can then in turn improve the funnel conversion rate. This is the rate of applicants who are approved for a loan over total number of applicants.

The company will continue to do exceptionally well, provided the percentage of applicants who are approved compared to the total applicants continues to grow. This will in turn increase the data of loan applicants, repayment data and further refine the AI to improve the detection on ideal applicants. This is noted as a “positive feedback loop” or a “flywheel effect”, similar to what was seen in the personal loans space. The best thing about this, is that the system keeps learning over time to better itself and make decisions with even better accuracy. The funnel conversion rate (noted as a diamond node) is a critical lynch pin in this network graph, since the positive loop is sustained only if the funnel conversion rate is positive and keeps improving.

A cascade effect of Prodigy, car dealerships and car loans

The second section of their auto lending concept map is the effect of Prodigy and its association with car dealerships (shown on right hand side of figure 4). Prodigy works with car dealerships to assist these businesses sell cars. It claims to streamline the process of car selling. The synergistic benefit of prodigy working with dealers to sell more cars is brought forth when a portion of these cars sold will also be financed through a upstart powered loan. The more cars prodigy helps sell, the more loans upstart can provide using its algorithm. This aspect of upstart is nascent and will continue to grow as more and more banks and credit unions sign up.

Overall, the concept maps exhibits good internal synergies and are sentiment positive.

A note on the work place philosophy at Upstart as a company.

Upstart is moving to a “digital-first model”, where most employees can live and work anywhere in the U.S. Besides the usual reasons for why hybrid or work from home has advantages for a place like Upstart, I would like to highlight a statement which is quite powerful as to the vision of what this company plans to do. “Given the scale of our ambitions and the talent we need to aggressively pursue our goals, we need to tap into talent across the entire country”

Concept card 4: Upstart and digital first model

Veuepoint.com (Self)

Conclusions

The semantic/concept network mapping has revealed several unique strengths and none critical deficiencies

Actionable considerations

The above article is not financial or investment advice. It is sharing my method of evaluating companies. I have worked with network graphs for more than a decade with applications to other field, this is the first foray to publish its application to company analysis formally. Comments and feed back are welcome.

Based on my concept analysis, Upstart Inc is a disruptor, filling an unmet need. It has the vision and an operating mechanism for growth. I am invested in Upstart. The company narrative is exceptional and as long as this narrative continues, I will stay invested.

Disclosure: I/we have a beneficial long position in the shares of UPST either through stock ownership, options, or other derivatives.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article