This week was miserable in the equities market. I feel that the momentum portfolio did just as well (or badly) or better (less poorly) than broad markets. But what a fricking sell off. Year to date, SPY (SP500) is down 12.99%, QQQ which tracks Nasdaq is down 21.17% and DIA which tracks the DOW 30 index is down 8.81%. This is perhaps the first clue into what markets have better momentum versus which sectors are doing poorly.

Results by month since start of momentum investing

Here are the month-to-month results of the portfolio

Month total return personal return index return

Mar 3.72% 2.68% 3.67%

Apr 0.55% -1.85% -9.09%

I use Morningstar to track my portfolio returns. According to Morningstar,

Total Return

Total Return measures the theoretical performance of your holdings for a specified period of time, taking into account the beginning and end values of your investments as well as dividends.

Personal Return

Personal Return calculates the investor's returns, taking into account an additional factor in its calculation: the capital that you added or withdrew from your fund or portfolio throughout the specified period of time. The calculation of Personal Return illustrates how your allocation of capital has affected the performance of your portfolio.

As seen in the returns comparison, the momentum portfolio has done well this week compared to the total US market index.

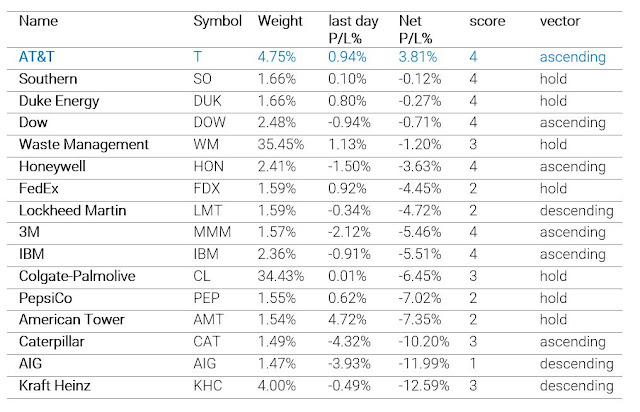

Positions and Positions Sizes

This bring us to the positions in my portfolio.

|

Momentum Analytics portfolio positions

|

The positions are their momentum scores are reported below

Name (Ticker, Composite momentum score)

1) American Tower Corp. (AMT, 2): AMT belongs to the real estate sector and specialty REIT industry. The specialty REIT industry is doing well this may provide the tailwinds that the company needs to sustain the long position. The Composite momentum score has been generally in the bullish zone since April 1st but tipped into the score 2 after the market meltdown on Friday. The price action has not been keeping up with the bullishness and I hope this represents a pullback and that the price will bounce back.

2) AT&

T Inc (T, 4): T belongs to the communication services sector and Fixed telecommunications industry. The Fixed telecommunications industry is doing well recently April 21, 2022 and this may provide the tail winds for the company. The Composite momentum score has been overall bullish since April 8th, 2022 the price action has been tracking sideways and hopefully indicates accumulation and further price increase.

3) Colgate-Palmolive Co (CL, 3): CL belongs to the consumer staples sector and personal products industry. The personal products industry is doing better than the average market this may provide the tailwinds for the company. The Composite momentum score has been bullish recently but has dipped into the HOLD (2) category since the market drop this Friday. Hopefully, this represents, resistance to further drop and the momentum is able to bring price back into the favorable position. If score falls further, it will trigger the sell rule.

4) Dow Inc (DOW, 3): DOW belongs to the Materials sector and Commodity chemicals industry. The commodity chemicals industry is doing well since April 7 and this may provide the tailwinds for the company. The Composite momentum score has been bullish

since January 13, 2022. The price action has been keeping up with the bullishness and I hope the recent drop represents a minor pullback

5) General Dynamics Corp (GD, 3): GD belongs to the Industrial sector and defense industry. The defense industry is doing well since January 14th and this may provide the tailwinds for the company. The Ukraine-Russia war is clear factor in the surging of the defense industry. The Composite momentum score has been bullish since January 13th, 2022. The price action has been keeping up with the bullishness and I hope the recent drop represents a minor pullback.

6) International Business Machines Corp (IBM, 3): IBM belongs to the Technology sector and computer services industry. The computer services industry is doing poorly overall but perhaps a small blip of improvement as of April 22nd, 2022. The Composite momentum score has been bullish only recently since April 20th, 2022. I anticipate this may fall back to HOLD category, then if the momentum were to continue, would take up again from there.

7) PepsiCo Inc (PEP, 2): PEP belongs to the consumer staples sector and soft drinks industry. The soft drinks industry is doing really well since January 3, 2022. The Composite momentum score has been bullish since April 20th, 2022 but fell to HOLD on last Friday.

8) Procter & Gamble Co (PG, 2): PG belongs to consumer staples, personal products industry. This industry has been only recently since April 22 doing better than its performance compared to the total market. Also PG is one of few on this list that has moved up in ranks from a bearish category to HOLD and then briefly a bullish score of 3, early part of last week. Friday sell off in the general market put it back into the HOLD but on the long side.

9) Raytheon Technologies Corp (RTX, 3): RTX belongs to Industrial sector, Aerospace industry. This industry as a whole as weakening momentum compared to its performance w.r.t total market. The ticker has been bullish since February 2 but I need to keep a close eye on this one. I am afraid the slowing momentum and weakening industry performance may trigger a sell signal, but lets see what the rules have to say when the time comes.

10) Target Corp (TGT, 3): TGT is in the consumer discretionary sector, broad line retailers industry. This industry has had a weak performance compared to the broader market indexes. The ticker went bullish on April 8 but fell to a 3 category after the broad market sell off on 4/29/2022.

11) The Kraft Heinz Co (KHC, 4): KHC belongs to consumer staples sector, food products industry. The stock price has had a robust momentum since February 15. Currently still at a score of 4 even with the market sell-off, has a ADX suggesting trending strength and tailwinds with industry performance, this stock has high chance of pulling back and stock price increase again.

12) T-Mobile US Inc (TMUS, 3): TMUS belongs to communication services sector, mobile communications industry. It was doing well with a momentum score of 4, until the Friday sell-off where the momentum score fell to 3, still a bullish score. It turned bullish on February 3 and continues to range in the bullish score trend. The mobile telecommunications industry performance however, if weakening.

13) Walmart Inc (WMT, 4): WMT turned to a bullish momentum score on March 7th and has been strong bullish since. The momentum is strong and hopefully reflects a minor pullback w.r.t last Fridays price action and recovery in next few days.

14) Waste Management Inc (WM, 4): WM belongs to industrial sector and waste and disposal industry. The scores turned to bullish on April 4 and continue to maintain a strong momentum.

Score classification

Score 0: Super bearish, no entry

Score 1: bearish, no entry

Score 2: if improving, not buying yet - "watchful for short reversal", if falling, not selling yet - "watch for long reversal"

Score 3: bullish, entry or hold

Score 4: bullish, entry or hold.

Sells

This week I sold TSLA at a small loss. Its score dropped from a 3 to 1 and I sold it for a 2.2% loss.

Adds

This week I added GD, IBM, PEP, PG this week. CL is one I am watching closely, based on momentum score it is not yet time to sell but if it falls to 2 then I will sell it. At present all the positions are at a loss as reported below

Individual Stock Performance

Name (ticker, unrealized gain/loss)

American Tower Corp. (AMT, -8.59%)

AT&T Inc (T, -0.56%)

Colgate-Palmolive Co (CL, -4.08%)

Dow Inc (DOW, -2.7%)

General Dynamics Corp (GD, -2.04%)

International Business Machines Corp (IBM, -2.59%)

PepsiCo Inc (PEP, -1.58%)

Procter & Gamble Co (PG, -0.67%)

Raytheon Technologies Corp (RTX, -5.6%)

Target Corp (TGT, -5.96%)

The Kraft Heinz Co (KHC, 4)

T-Mobile US Inc (TMUS, -3.58%)

Walmart Inc (WMT, -2.75%)

Waste Management Inc (WM, +5.15%)

Next update 5/8/2022, until then keep tracking the momentum.